With the start of a new year, I’ve been thinking about what we’re doing here, and how I want to evolve Prime Future in 2023.

While my why has not changed since the beginning:

- learn out loud

- find my like-minded industry people

I have increased clarity on what I’m not about:

- I am not here to ‘fix a broken food system’. Food supply chains largely held in one of modern society’s wildest black swan events (COVID). I haaaate the sound bite-ness of this overused line but it’s true for the most part: animal protein is abundant, affordable, and nutritious. So let’s not act like we need to start from zero, k?

- Alternatively, I am not here to defend the status quo.

What got us here won't get us there.I loathe the term agvocate, but I think I loathe the idea behind it even more – it’s an inherently defensive posture that does nothing to move the needle.Some things are going to have to change about how animal protein is produced and marketed, and that’s great…early adopters will find/create opportunity. - I do not think carbon credits will create more revenue for ranchers than beef. An astute friend of mine recently made this observation: in an industry that is really good at creating value from its byproducts, I can’t even name one example where a byproduct of a commodity became more valuable than the primary commodity itself. (Open to counter examples here!)

And increased clarity about what I am about:

- I’m bullish on the future of animal protein. And the future likely looks very different from the past.

- What are the macro-trends across livestock, meat & dairy? And what are the micro-implications of those macro-trends?

- Looking at the world from a cross-species, cross-value chain perspective. I want to understand at a practical level and big picture.

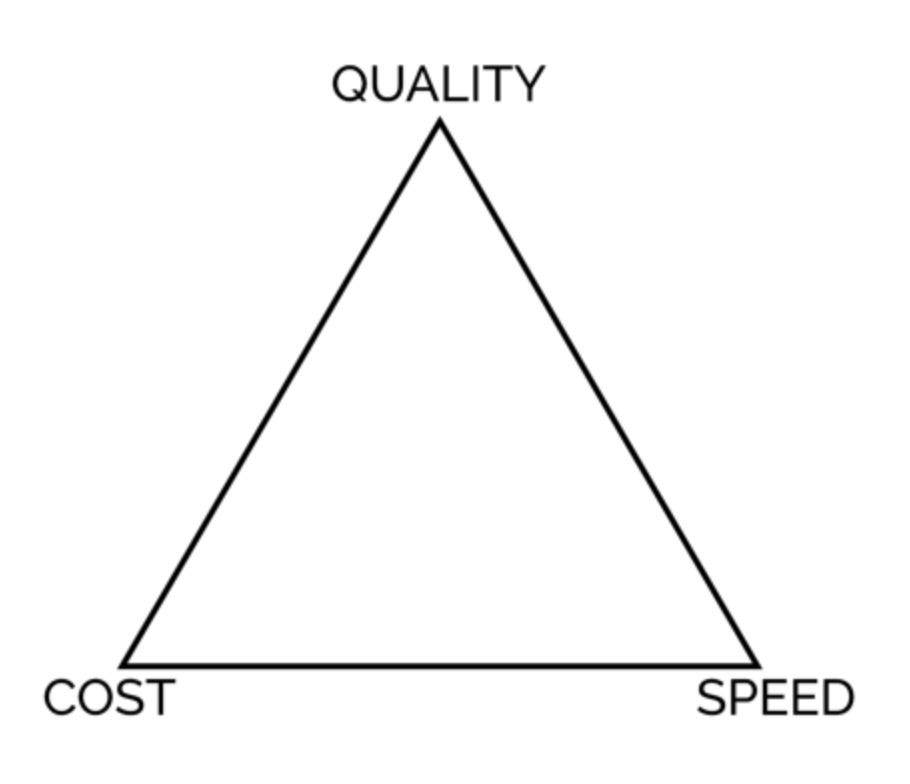

- Keeping the main things the main things: the twin pillars of producer viability and end customer satisfaction. Everything in the middle of the value chain sorts itself out of the twin pillars are sound.

- Data is the answer to many many questions but only when technology fits a production context – durability, connectivity, time, usability, cost, etc – and the value proposition is right.

I’m here <gestures vaguely> because what interests me is innovation that creates real value, especially business model innovation, whether that innovation is tech-enabled, or not.

With that backdrop, here are my three intentions for this year with Prime Future:

- Keep two lenses active:

- What’s likely to change in the next 10 years?

- What’s likely not to change in the next 10 years?

- Go to the source. Ask the questions. Talk with really smart people and then do my own analysis; draw my own conclusions.

- Get global. My little US bubble is tiny, there’s a whole world of livestock production systems and creative innovations out there to learn from. This year I want Prime Future to get way more global.

Some questions I want to explore this year:

- What can beef and dairy learn from pork, poultry, and aqua? Vice versa?

- What can the US learn from New Zealand, Sadia Arabia, etc? Vice versa?

- What can livestock learn from the crop side of the industry?

- What can livestock learn from energy or other unrelated industries?

- How is the animal nutrition world changing?

And finally, process over outcomes.

The last few years have been a journey in realizing that I control my day-to-day choices much more than I control outcomes. When you say something like “process over outcomes” people tend to get jumpy and think of bureaucratic organizations, but I mean “process over outcomes” as an individual.

An example is investing. I could set the goal to have a portfolio of x by the end of the year, but the stock market could drop 50% in Q4 and leave me with a seemingly bad outcome for the year. Or, I can focus on my process by setting a goal to invest x% of my monthly income in the stock market or real estate. In the short run, I have much more control over my personal process than outcomes. Over time, that discipline should pay off.

So here’s how I’m thinking about Prime Future processes:

- Continue publishing weekly.

- Start conducting 1 interview per month with an operator who has either started and/or grown a business over a period of time. (open to ideas!)

- Start writing 1-2 sponsored deep dives per quarter about interesting companies that communicate something about the future of the industry. (open to ideas!) Examples from last year include The Magic in Solving Invisible Problems and Rising from the Averages: A Cattle Story.

- Stop writing my first draft on Friday/Saturday. I keep a running list of potential ideas which I narrow down to a topic I want to write about on Friday afternoon or Saturday morning. This leaves me with only the weekend to edit before publishing Monday morning. I want to stop this.

- Start writing the first draft on Monday afternoon, so I have an entire week for the hardest, and highest ROI, part of the writing process: editing.

I hope you are kicking off a fantastic 2023! What a time to be alive 🙂