Every company on the face of the planet (and someday on Mars) does 3 things:

- buys stuff to

- make stuff to

- sell stuff

Using that oversimplified framework, in our last stop in this series let’s look at the downstream implications of ‘beef on dairy’ for cattle feeders, packers, and retailers.

Keep in mind, we’re talking about a max of ~5 million out of ~25 million fed cattle per year in the US.

Feeders gonna feed.

Success in cattle feeding is based on a 3 variable equation:

- Quantity & price of lbs out the door (selling cattle right)

- Minus the quantity & price of lbs in the door (buying cattle right)

- Minus the cost of lbs added at the feedyard (feeding & managing cattle right)

Those 3 levers make feedyards the segment in the beef value chain with the most flexibility. That flexibility makes cattle feeding a reeeeally dynamic business allowing feeders to shift strategy with trends in the market, the cattle cycle, or grain prices. It’s also what makes cattle feeding really hard.

When it comes to feeding native cattle (beef), dairy, or beef x dairy crosses, cattle feeders find what works as they triangulate risk profile on the buy, feeding & management, and relationships/proximity to plants that process certain types of cattle. There are both the management & nutrition elements of feeding different or new-to-you types of cattle that can take some time in learning how to adjust lever #3 above, cost of gain. But just as important are levers #1 and #2 which are driven by the relationships and partnerships and arrangements that surround a cattle feeder’s strategy as it relates to how they buy and how they sell cattle. All 3 levers have some degree of learning curve when it comes to beefxdairy, though waaay less than a beef cattle feeder jumping into feeding dairy cattle.

My hypothesis is that because large dairies are leading the way with ‘beef on dairy’, the animals tend to move as large lots under negotiated agreements rather than moving as smaller lots through sale barns. The result is increased visibility to production history, and decreased risk….not a bad combo for a cattle feeder.

One opportunity for cattle feeders is if these large dairy systems look to maintain ownership of cattle through the supply chain to capture more value all the way to the packer, will that create more low risk custom feeding opportunities. If the balance of feedyard owned cattle vs custom feeding cattle for others tends to cycle with the broader cattle cycle and feed price fluctuations, could this increase the amount of predictable custom fed business? Maybe, maybe not.

~5 million dairy calves have been part of the beef value chain for decades. All ‘beef on dairy’ does is create an opportunity to level up, to get the best of beef and dairy genetics for performance in a feedyard and in the plant. Shifting from 280 days in a feedyard for Holsteins to <180 days in a feedyard for Hogus cattle is, um, a big deal.

One aside: For the segment of dairy cows that are bred to a beef bull using AI, the math doesn’t (yet) make sense to use sexed semen so 50% of those offspring will be heifers. Heifers are typically considered less profitable for a feedyard than steers. If/when it becomes economical to use sexed semen for all calves from a dairy that are headed into the beef value chain, there will be another inflection point. The view on heifers is another example of the difference in beef goals vs (traditional) dairy goals, since heifers are significantly more valuable to the dairy producer.

Packers gonna pack…but at what price?

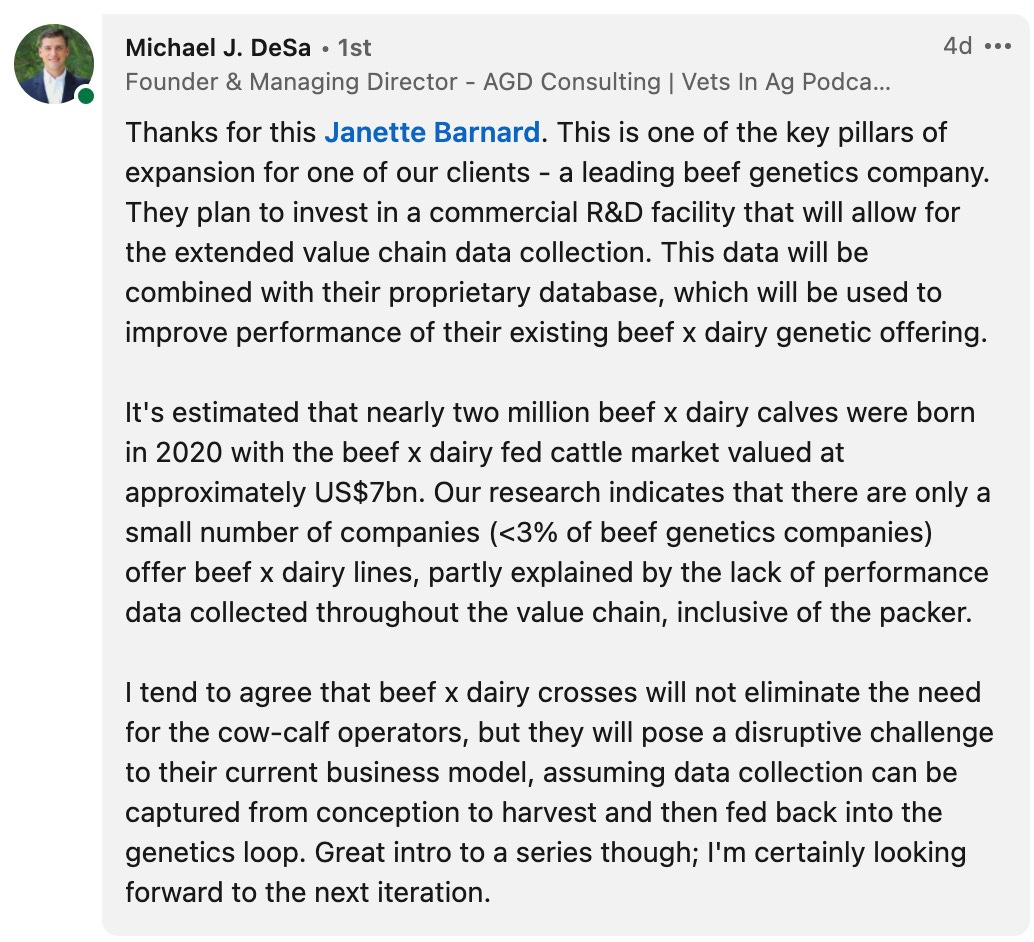

We talked about the BIG idea of beef on dairy value chains to accelerate aligned supply chains in beef since they are absolutely critical to maximizing the value of beef x dairy carcasses. Beef on dairy value chains *have* to have a direct relationship with the packer. This partnership mentality, from producer to calf ranch to feedyard to packer, is essential to ensuring beef-dairy cattle are priced according to the value of the carcass, with its beef characteristics.

But as long as the ‘right’ genetics have been selected to drive desirable carcass traits the packers are looking for, then these animals should be priced like their native peers. If the dairy’ness has been offset by the terminal beef genetics, then once the animal arrives at the packing plant there *should* be no subsequent difference in process or how that beef is sold. It’s just beef by the time the carcass is disassembled and prepared for the meat case at retail.

Which leads us to….

Retailers gonna…cringe a bit.

To the extent beef x dairy meat went into mainstream channels & programs at the packer, then they show up in the meat case just like meat from any native (beef) animal. Zero impact there.

The real question is, will retail brands be built around beef on dairy?

Here are the reasons FOR beef x dairy focused brands:

- Consistency in supply, consistency in product given the tight dairy gene pool. The consumer will get the same experience every.single.time. That seems brand’able.

- Transparency into supply given the ‘aligned supply chain’ nature of this beast that is required. Want to know how this animal was raised, where it’s been, how it was fed? We gotchu.

- Sustainability. Let’s say for illustrative purposes (don’t @ me) that each cow uses 1 unit of environment per year. The beef cow produces 1 unit of food supply per year with a calf. So we can loosely say that b

eef = 1:1 output to input ratio.But wait a sec, here comes the dairy cow who also uses 1 unit of environment per year but she produces 1 unit of food supply per year through milk production PLUS 1 unit of food supply with a high value beef x dairy calf.Dairy = 2:1 output to input ratio.The dairy cow is the super star when you frame it that way.

It’s a made-for-the-meat-case story.

But there’s a catch: The calf ranch.

Regardless of how well cared for the calves are, kept out of the elements, given appropriate feed and water and nutrition…brand new baby calves in hutches isn’t something thats likely to play well in a social media world that runs on sound bites & spin rather than nuance. Until there’s an alternative to the current calf rearing link in the supply chain, there’s likely to be limited retailer / brand appetite for marketing beef x dairy crosses in a direct way.

And yet, given how great the value proposition is for a fully aligned beef x dairy supply chain from dairy to meat case, I have to believe that someone is going to find a meat case friendly solution for calf rearing.

And when that happens? Game on.

Summary

We’ve covered a lot of ground in this 5 part series – I have learned so much from all the people who’ve shared their insights along the way. My takeaway from the series is that beef on dairy isn’t everything, but it is definitively something:

the 3 ideas that make beef-on-dairy punch above its weight class:

- Beef x Dairy cross carcasses are as good or better than straight beef carcasses. (Think of it as having your cake and eating it too, but ya know, beef.)

- Beef-dairy crosses hold a consistency advantage over the traditional fragmented beef value chain.

- Beef-dairy cross value chains are forcing new partnerships in order to capture full value at the packer level.

Which is all fine and well, until we come back to the math of beef on dairy. If we are really only talking about 5M calves annually, out of 25 million total fed cattle, it raises the question of….so what?

What happens with 5M beef dairy crosses is interesting, but the really fun part will be seeing how the 5M could influence the 20M.

Imagine that cattle feeders and packers and retailers get used to all those benefits mentioned above that are

inherentto the beef x dairy value chain. Now use the exceptionally limited amount of imagination to picture those expectations bleeding over into the other 80% of beef, the natives. Not much imagination required, huh?

The unknown is how the beef value chain will respond and how long it will take to catch up & recreate the rapidly accelerating advantages of the beef on dairy value chain.Is this a 30 year dynamic or a 5 year dynamic? TBD.

ICYM the rest of the series

The first 4 of this 5 part series on how the ‘beef on dairy’ genetics strategy could impact the beef & dairy industry in the United States:

(1) How the ‘beef on dairy’ genetics strategy will impact cow-calf producers. Spoiler alert: not much, mathematically speaking.

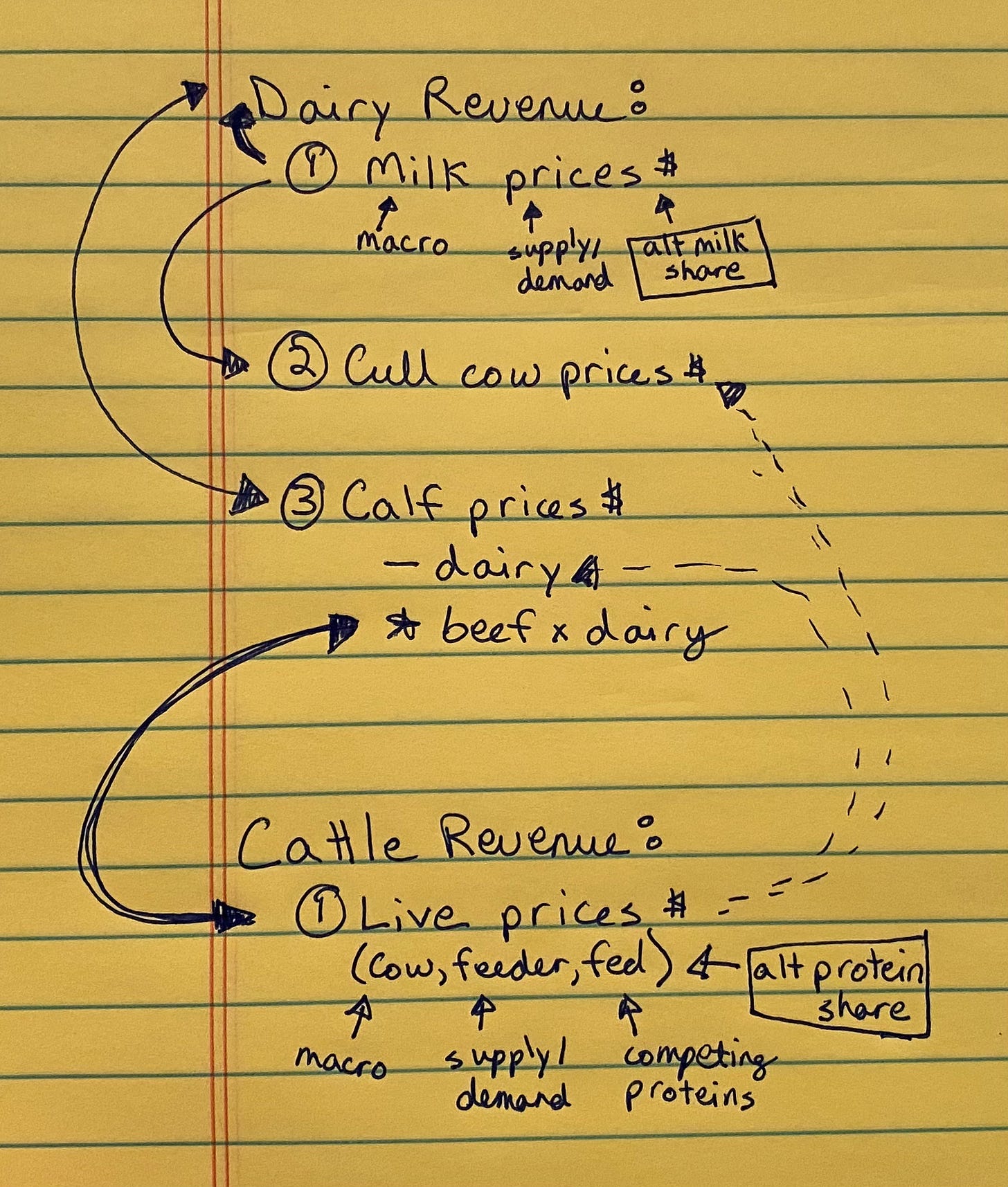

(2) What’s driving this beef on dairy thing from the dairy producers POV. tldr: its complicated.

(3) 💡 3 reasons why dairy is the new beef. It’s not about the 5M, it’s about how the 5M influence the remaining 20M fed cattle.

(4) If dairy is the new beef, where do the alts fit? A look at how alternative milk and meat market share might impact milk and meat prices now that the two are even more interdependent.

GET THE BEEF-ON-DAIRY EBOOK 🐄

I’m interested in all things technology, innovation, and every element of the animal protein value chain. I grew up on a farm in Arizona, spent my early career with Elanco, Cargill, & McDonald’s before moving into the world of early stage Agtech startups.

I’m currently on the Merck Animal Health Ventures team. Prime Future is where I learn out loud. It represents my personal views only, which are subject to change…’strong convictions, loosely held’.

Thanks for being here,

Janette Barnard